Tax Strategy Amplifies Donors’ Giving Power

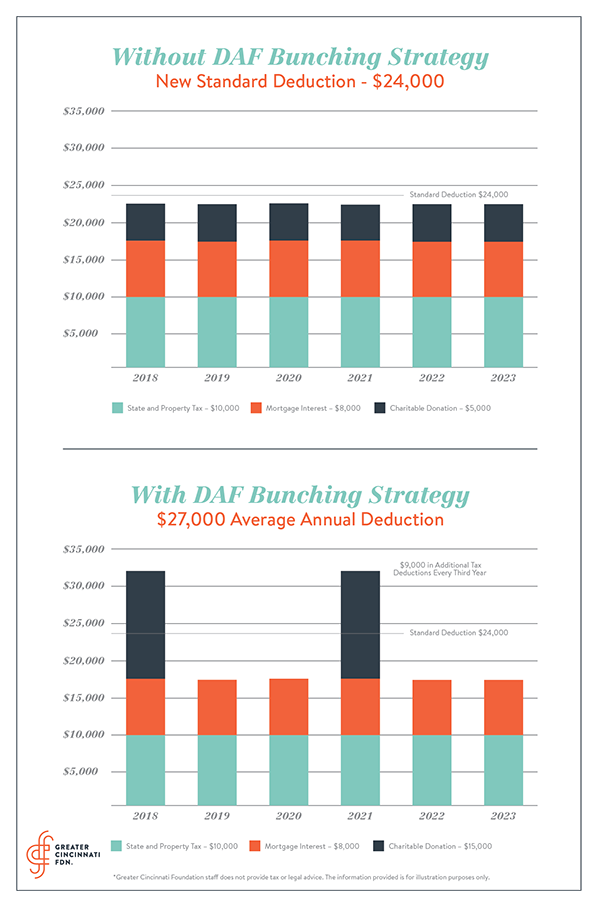

The Tax Cuts and Jobs Act of 2017, which takes effect this tax year, has raised questions about its potential effect on charitable deductions and contributions. These new tax rules passed by Congress nearly doubled the standard deduction for couples — from $12,700 to $24,000 — while simultaneously limiting many itemized deductions, including property taxes and mortgage interest. Because of this, there is speculation that the percentage of taxpayers itemizing their deductions in 2018 will decrease, and that it will impact the tax incentive to give charitable donations.

At Greater Cincinnati Foundation, we know that you are passionate about your giving, and that a tax break is far from being the only factor. We also understand that it’s important to leverage the power of your contributions by considering the best tax advantage. That’s where a strategy for your donor advised fund, known as bunching or bundling, comes into play.

Here’s how it works: By “bunching” or grouping two or three years of your regular giving amounts into the first year —along with other itemized deductions — you can accrue a total that is higher than the standard $24,000 deduction (for couples) or $12,000 (for single taxpayers). Through your donor advised fund, the charitable donations can be distributed in multiple years, but you obtain the tax deduction in year one. In year two (and three, if you set up the distribution over three years), you then take the standard tax deduction.

Bunching can be especially beneficial during a high-income year. Moreover, it maximizes the power of your giving to the causes that are important to you. Working with GCF connects you with others who care about making a purposeful difference in our community. Through unmatched personalized service and flexibility of giving options, GCF amplifies the imprint of your generosity.

For further information about bunching options through donor advised funds, please contact our Donor and Private Foundations staff.

*Greater Cincinnati staff does not provide tax or legal advice. The information provided is for illustration purposes only.