Gifting Business Assets

Amplify Your Impact

GCF can help you find the optimal way to use privately held C-Corp or S-Corp shares, real estate or other non-cash assets to fuel your charitable giving.

Working with your advisors, we can help you achieve the ideal arrangement for improving your tax status — both now and for generations to come. For nearly 60 years, GCF has partnered with families to support their philanthropic legacy.

Connect

Michele Carey, CAP®

Vice President, Philanthropic Strategies

513-768-6171

michele.carey@gcfdn.org

|

|

Four Smart Reasons for Giving Business Assets

Why is it smart to make a gift of business interests instead of writing a check? In most cases, a charitable contribution of an appreciated asset allows a donor to deduct the value of the asset without having to report the appreciation as income.

The current fair market value of an illiquid asset, on which charitable deductions are based, is often considerably higher than the cost basis, or original cost, of the asset.

Typically, donors can enjoy a charitable deduction equal to the current full fair market value of the gift, as determined by a qualified appraisal.

Donors can usually avoid capital gains taxes that would incur if they were to sell illiquid assets and then make a charitable gift.

The taxes you save help to grow your donor advised fund at GCF! With one gift you can provide impactful support over time to multiple charities and causes you care about most.

Optimize Donations with Noncash Assets

by Bryan Clontz

As you consider your charitable priorities, your accountant may have already discussed the advantages of making a charitable gift of publicly-traded stock that has appreciated in value over time. The same advantages are true for other appreciated assets, including closely held stock, LLC interests and real estate.

Donor Advised Funds

Donor Advised Funds are a convenient, versatile tool that many individuals and organizations use to effectively plan and manage charitable gifts. Receive a tax deduction when you make your gift, and take your time deciding which charitable causes and organizations to support. Our team is here to support you for every step of your philanthropic journey.

Making Charitable Gifts with Closely Held Stock and other Appreciated Assets

Many people think charitable giving means giving cash. But what if you could be charitable without giving cash, help the community and realize significant tax savings?

Leave your cash in your wallet. Donate a portion of your business to a donor advised fund to reduce your taxes and create a charitable treasure chest that you can use to support the organizations and causes you care about over time.

Curious to learn more? View this webinar with nationally recognized non-cash charitable gift expert, Bryan Clontz, to see how a charitable contribution of highly appreciated C-Corp or S-Corp shares, LLC units, or real estate offers an opportunity for a fair market value tax deduction and elimination of capital gains tax to fuel your charitable giving.

Supporting Our Community

Greater Cincinnati Foundation helped Bob Coughlin use his Paycor stock to make charitable gifts of more than $2.4 million—benefiting the community and fueling his impact.

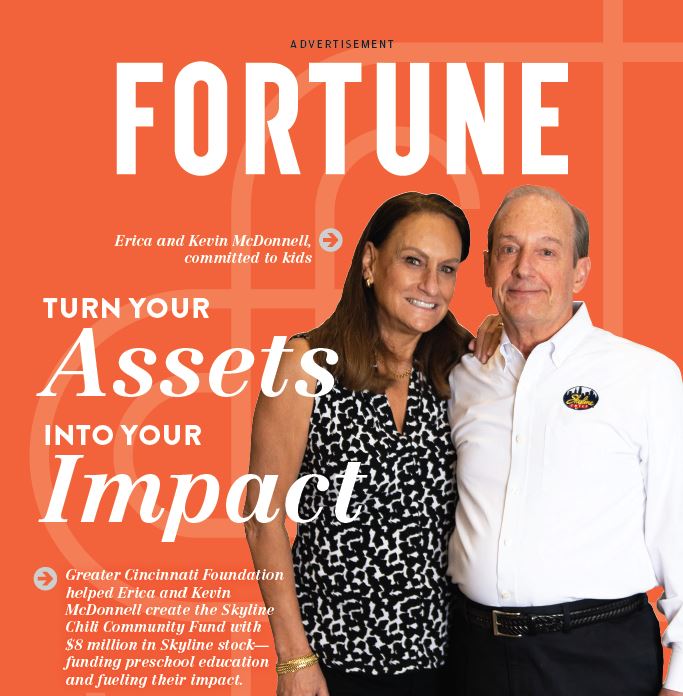

Read moreGreater Cincinnati Foundation helped Erica and Kevin McDonnell create the Skyline Chili Community Fund with $8 million in Skyline stock— funding preschool education and fueling their impact.

Read moreBob Coughlin

Founder, Paycor

“When I started the fund, I had the notion that I’d use Paycor stock as one of the vehicles, because it had tax advantages… Greater Cincinnati Foundation is easy to do business work, very easy.”

Kevin McDonnell

CEO, Skyline Chili

"We all recognize the need to give back. For me, it started with trying to explore how I could transition my ownership at Skyline and do good in the community with some of the good fortune my wife and I had."