Endow Kentucky: $6.2 Million Designated for Kentucky and Counting

“We love Endow Kentucky because we can make gifts that will last and have an impact on Northern Kentucky for a long time. The state tax credit to incentivize these gifts is so helpful in building support for important organizations in our community. It’s a win-win.” — Jordan and Lauren Huizenga, Covington residents who support Learning Grove through a GCF endowment

The Commonwealth of Kentucky offers a tax-smart way for Kentucky income taxpayers — both individuals and businesses — to provide sustained support to their favorite Bluegrass-based nonprofit organizations, including schools and religious institutions. The Endow Kentucky Tax Credit enables them to receive a state tax credit of up to 20 percent of a charitable gift to an endowment for any Kentucky nonprofit at a qualified community foundation such as Greater Cincinnati Foundation (GCF).The window for applying for the 2021 fiscal year tax credits opens on July 1, but it’s a brief opportunity. The $1,000,000 in tax credits available statewide will again likely all be claimed in the first week, so it’s imperative to submit the application to the Kentucky Department of Revenue before July 7.

Since 2011, GCF has helped many of our Northern Kentucky donors secure the Endow Kentucky tax credit. Their gifts, totaling $6.2 million, have benefited 24 GCF endowments that permanently support Kentucky nonprofits, including:

- Alliance for Catholic Urban Education

- Brighton Center

- Children’s Home of NKY

- Covington Partners

- Diocesan Catholic Children’s Home (DCCH)

- Learning Grove

- The Life Learning Center

- Redwood

- St. Elizabeth Healthcare

- St. Elizabeth Hospice

- United Way, Northern Kentucky

Donors also leverage the tax credit to support The Northern Kentucky Fund, GCF’s unrestricted endowment that provides ongoing grants in Kenton, Campbell and Boone counties.

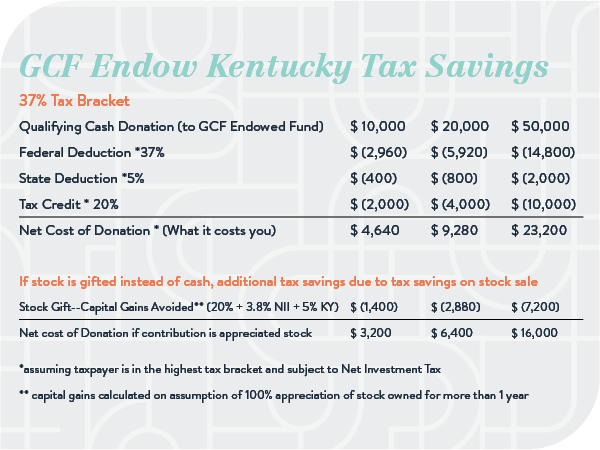

The tax credit — taken off the donor’s tax bill dollar-for-dollar — is up to $10,000 per taxpayer, or $20,000 per married couple filing jointly. And state and federal tax deductions for the charitable gifts still apply. Gifts may be either cash or stock; long-term, appreciated stock gifts offer even greater tax savings. As always, consult your tax advisor for information specific to your situation.

It’s important to note that this isn’t just a tax credit for major gifts — donations of any size contribute to the lasting impact of endowed funds while simultaneously reducing your Kentucky income tax payment.

Contact your experienced staff members at GCF to further discuss the Endow Kentucky Tax Credit. Laura Menge, Sr. Philanthropic Advisor, can help you plan a qualifying gift (513-768-6170 or laura.menge@gcfdn.org).